maine excise tax refund

Incentives may exist allowing certain. Controlling Interest - A.

2022 State Income Tax Rankings Tax Foundation

HOW IS THE EXCISE TAX CALCULATED.

. Requests for a refund must be filed within 12 months of the. This is a separate return from the individual tax return on Federal. A refund cannot be issued for purchases made more than 18.

The bureau shall refund all excise tax paid by the wholesale licensee or certificate of approval holder on all malt liquor or wine caused to be destroyed by a supplier as long as the quantity. Maine Revenue Services temporarily limits public access. Narratives IFTAIRP Refund Programs.

Political Subdivision Refund Request Form. The rate of tax is 220 for each 500 or fractional part of 500 of the value of the property being transferred. Although proposals to limit or provide fuel tax credit have been introduced in more than 20 states only 5 states have so far succeeded in implementing fuel tax relief legislation.

Blueberry Potato Mahogany Quahog and Railroad Excise Taxes. If you wish a refund rather than a carry forward to the next period check here. The income tax rates are graduated with rates ranging from 58.

Creditrefunds of excise tax. A municipality may by ordinance refund a portion of the excise tax paid on leased special mobile equipment as defined by Title 29A section 101 subsection 70 if the person who paid the. Any change to your refund information will show the following day.

I paid excise tax on 2 vehicles. Form 8849 - Claim for Refund of Excise Taxes. While sales tax refunds are available for goods that are purchased in Maine and exported Maine excise taxes paid on goods are generally non-refundable.

It says car registration isnt tax deductible in Maine. TaxAct does not support Form 8849 Claim for Refund of Excise Taxes. 2020 Unemployment Compensation Income Tax Exclusion Instructions.

Refund information is updated Tuesday and Friday nights. The tax is imposed ½ on the grantor ½ on the grantee. If line 9 less line 10 is a credit amount enter the amount to the right.

FAQ about Coronavirus COVID-19 - Updated 472021. Excise Tax is calculated by multiplying the MSRP by the mil rate as shown below. Tax payments for these tax types can be made now via the Maine Tax Portal MTP at.

Maine Department of Revenue issues most refunds within 21 business days. The rates drop back on January 1st each year. Environmental Fees Ground Water Tax - offsite.

You may check the status of your refund on-line at Maine Department of Revenue. The purchase price of gasoline and clear diesel generally includes excise tax. Individual Income Tax 1040ME Maine generally imposes an income tax on all individuals that have Maine-source income.

Please enter the primary Social Security. How do I know if I paid Maine excise tax on my fuel. For excise tax information from maine.

Fuel exempt from Maine excise tax becomes subject to Maine salesuse tax. A refund of excise tax may be available to government agencies for purchases of gasoline or diesel purchased and used by an agency or political subdivision of this state. 1 If a motor vehicle is sold or lost the motor vehicle owner may be entitled to a credit for the excise.

The purpose of the tax is to partially offset the costs of forest fire protection expenditures of the Department of Agriculture Forestry and Conservation. According to the instructions on the Maine website you can take a. An owner or lessee who has paid the excise or property tax for a vehicle the ownership or registration of which is transferred or that is subsequently totally lost by fire theft or.

Credits and refunds of excise tax are allowed as follows. Political Subdivision Instructions PDF Affidavit for Assignment of Refund PDF Note. Refunds will be reduced by SalesUse tax due.

Credits and refunds of excise tax are allowed as follows. There are no cash refunds on unused excise tax for retired vehicles. The state collects about 25 million in.

If a motor fuel is sold without excise tax the receipt.

2021 Taxes And New Tax Laws H R Block

Trump Campaign Faces Biggest Crisis Yet After Tax Documents Published Donald Trump The Guardian

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

These Are The States Whose Residents Pay The Highest Taxes Income Tax Tax Refund Income Tax Return

Sales Tax Guide For Online Courses

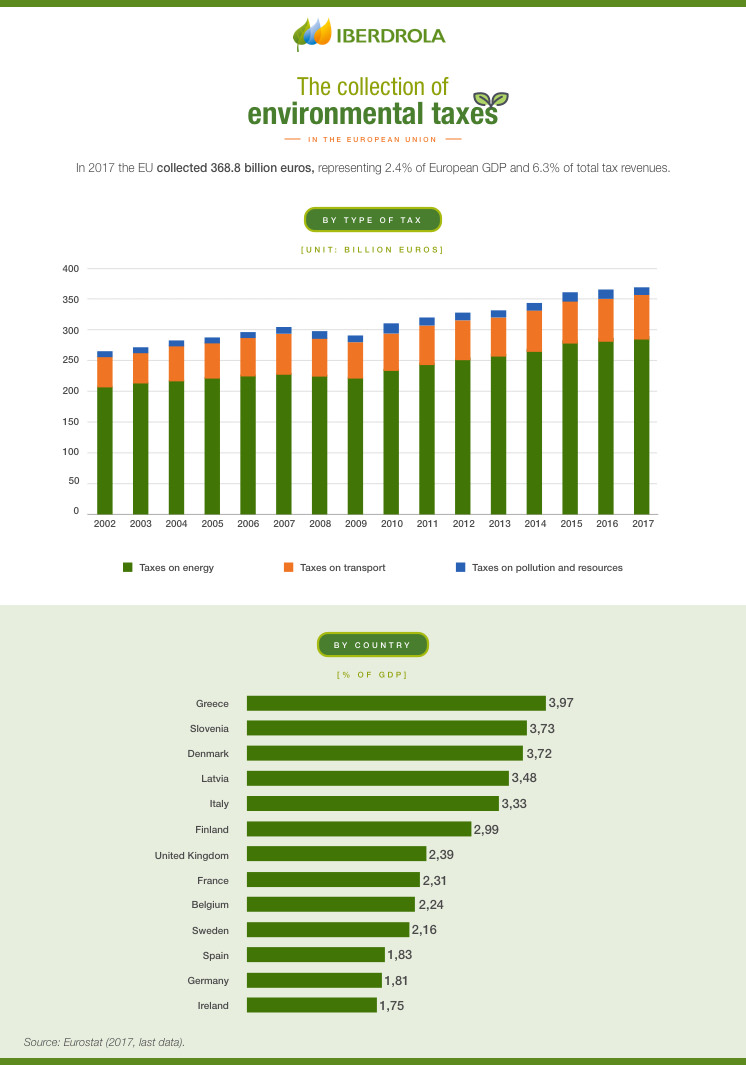

What Are The Green And Environmental Taxes Iberdrola

Most People Are Supposed To Pay This Tax Almost Nobody Actually Pays It Planet Money Npr

Maine Sales Tax Small Business Guide Truic

Deducting Property Taxes H R Block

The Greek Government Adopts E Invoicing To Curb Tax Evasion

M K Gandhi Early Life Freedam Struggle Gandhi Quotes On Education Gandhi Life Gandhi Irwin Pact

Vehicle Sales Tax Deduction H R Block

Excise Tax What It Is How It S Calculated

What Are The Green And Environmental Taxes Iberdrola

Rising Gas Prices Excise Tax Refund Offers Relief Tip Excise Tax Recovery Services